Likewise, if this happens, the company needs to make the journal entry for factoring receivables with recourse as below: Account Debit Credit Cash 000 Loss on sale of receivables 000 Due from factor 000 Recourse liability 000 Accounts receivable 000 based on past experiences), the company needs to make provision for it. The company is usually required to disclose this contingent liability in the notes to financial statements.Īnd if the amount of the contingent liability is material and it is likely to happen (e.g. Likewise, the factoring receivables with recourse will result in contingent liability on the company. In other words, the company selling receivables still bears the risk of nonpayment from customers and the factor can demand the money back if the receivables cannot be collected.

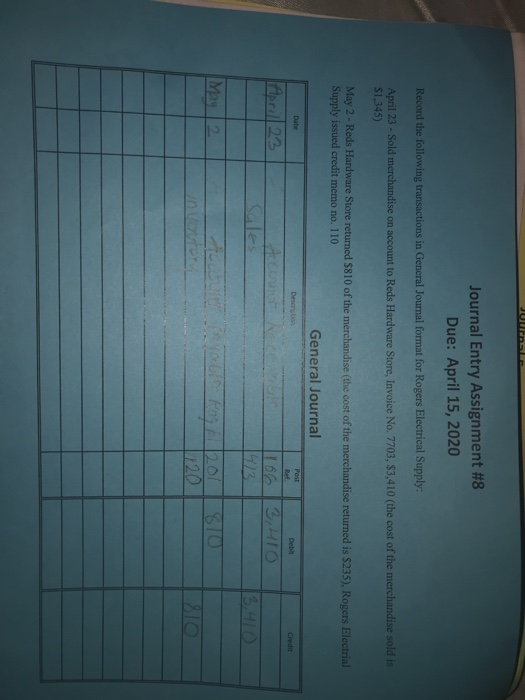

In this case, the company ABC can make the factoring receivables journal entry for selling of $100,000 receivables as below: Account Debit Credit Cash 80,000 Loss on sale of receivables 5,000 Due from factor 15,000 Accounts receivable 100,000 Factoring receivables with recourse vs non-recourse Factoring receivables with recourseįactoring receivables with recourse means that the company selling receivables is liable to the factor if receivables cannot be collected. The company receives total cash of $80,000 from the sale transaction while the amount of $15,000 is retained by the factor as security against bad debts and at the same time, the factor charges a 5% fee on receivables which is $5,000. Factoring receivables exampleįor example, the company ABC sells its receivables of $100,000 to a factoring company in order to receive early cash for its business operation. Likewise, the factor will pay this withheld amount to the company when those amounts in invoices are collected. The due from factor in this journal entry is the amount that the factor withholds in order to cover the risk of bad debts that may occur. In this case, the journal entry will need to include this security sum in the due from factor account as below: Account Debit Credit Cash 000 Loss on sale of receivables 000 Due from factor 000 Accounts receivable 000 20% of receivables) as a security against any bad debt that may arise. However, the factor usually withholds some amount (e.g. This journal entry is straightforward as there is no withholding amount kept with the factoring company.

Loss on sale of receivables is an expense that the factoring company (the factor) charges on transferring of receivables. Account Debit Credit Cash 000 Loss on sale of receivables 000 Accounts receivable 000 The company can make the factoring receivables journal entry by debiting the cash account and loss on sale of receivables account and crediting the accounts receivable. And if such contingent liability is material and is likely to occur, the company not only needs to disclose it in the notes on financial statements but also needs to make provision for it by recognizing the loss immediately. This is due to the factoring receivables with recourse will generate the contingent liability to the company that sells receivables. In this case, the company needs to make the factoring receivables journal entry whether the factoring receivables is with recourse or without recourse.įactoring receivables with recourse and without recourse may be a bit different from each other. In business, the company may need to sell its receivables which is called factoring receivables if it needs early cash for its business operation and cannot wait to collect all receivables. Factoring Receivables Journal Entry Overview

0 kommentar(er)

0 kommentar(er)